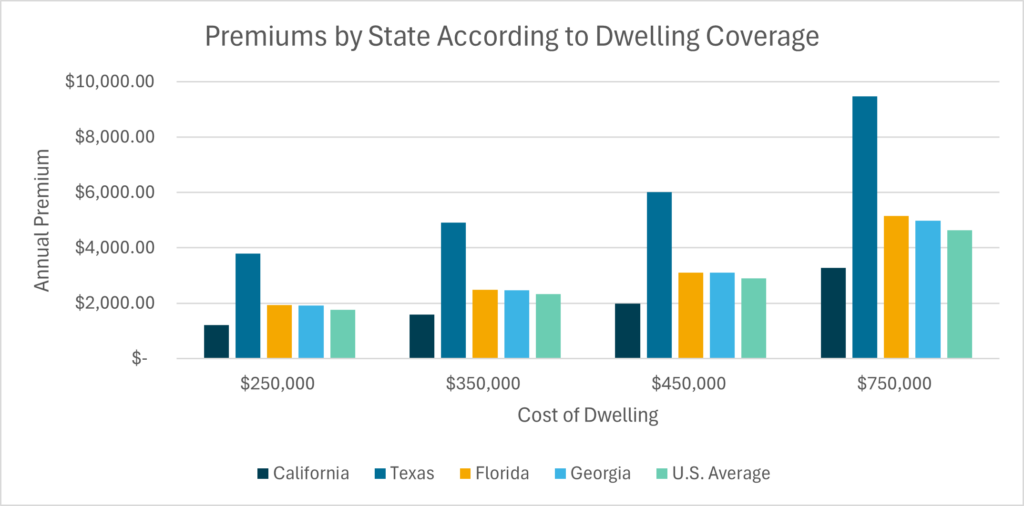

Housing operators across the country have had to deal with significant increases in insurance costs over the past year. According to Bankrate, the national average homeowner’s insurance cost increased by roughly 23 percent for a policy with $250,000 in dwelling coverage between 2023 and 2024.

An uptick in costly climate-related disasters has forced insurers to pass on the costs to customers. As a result, carriers have scaled back business in states like California, Florida, Georgia, and Texas. As the chart below shows, many of these markets are experiencing costs above the national average. In some cases, such as in California, insurance providers have even decided to leave the state all together, limiting coverage options and driving up premiums.

Source: Bankrate, Quadrant Information Services

With the growing risk of wildfire, wind, and flood damage, more than 39 million properties, or nearly 27 percent of the total properties in the continental U.S., are at risk of higher insurance premiums or losing coverage according to First Street Foundation.

Increasing premiums are expected to adversely affect affordable housing. The National Leased Housing Association (NLHA) recently partnered with NDP Analyticsto conduct a survey among operators to analyze the impact of rising insurance rates on affordable housing providers. The survey took place in the third quarter of 2023, and respondents operated over 1.7 million affordable housing units.

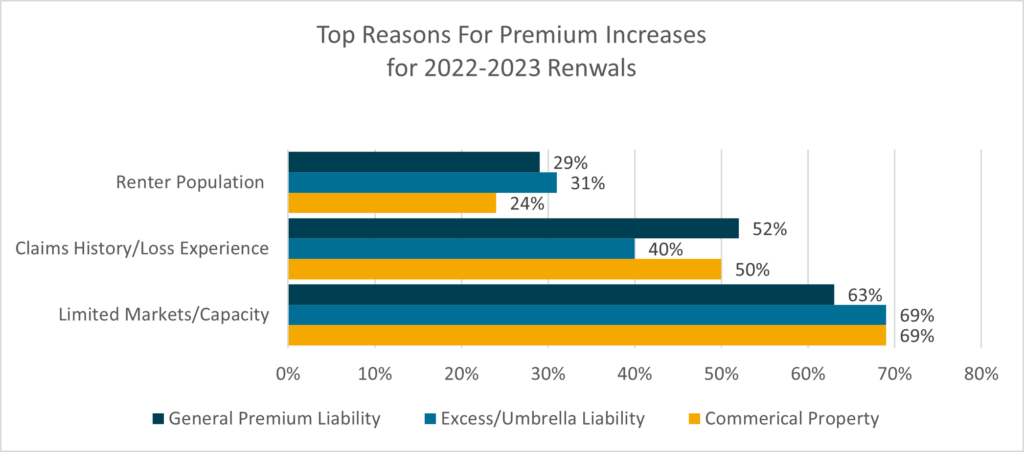

The study found that housing providers are accepting less coverage as premiums increase. From 2020 to 2021, more than 86 percent of commercial property, premium general liability, and excess/umbrella liability policies were renewed with the same or similar levels of coverage. However, for the 2022 to 2023 policy year, only 57 percent of policies continued with the same or similar levels of coverage.

Additionally, nearly one in every three policies had rate increases of 25 percent or more from 2022 to 2023. As a result, many operators suggested they would decrease or postpone investments or updates to current housing units and/or future projects, reduce insurance coverage, or increase rents, harming the property’s affordability.

Source: NDP Analytics

Builders of affordable housing get federal and local subsidies in the form of tax credits. As such, they must rent out apartments at below-market rates. However, if insurance costs continue to rise, it may deter developers from financing new affordable housing, since they are unable to raise rents to offset higher expenses.

Furthermore, existing affordable housing operators could be incentivized to let a property’s affordability status expire in order to increase rental revenue. With a shortage of roughly 7.3 million affordable homes in the U.S. according to National Low Income Housing Coalition (NLIHC), a lack of development and preservation will exacerbate an already existing affordable housing shortage.

Connect with one of our trusted affordable housing advisors today.