On April 1, the U.S. Department of Housing and Urban Development (HUD) published the 2024 Income Limits, which determine eligibility for assisted housing programs as well as Multifamily Tax Subsidy Project (MTSP) income limits that determine eligibility for Low-Income Housing Tax Credit (LIHTC), and tax-exempt private activity bond financed properties. These limits set the maximum amount a household can earn and still qualify for income-restricted housing.

Fiscal year (FY) 2024 represents the first year a ceiling on the cap has been enacted. Previously, HUD limited all annual increases to the greater of 5 percent or twice the change in the national median family income. However, HUD adjusted the methodology to incorporate a ceiling for FY 2024, restricting limit increases to no greater than 10 percent. Notably, according to Novogradac, the cap would have been at 14.8 percent without the new restrictions.

As a result of the new cap, LIHTC properties could be more rent-restricted. This could have significant ramifications for affordable property development as tighter margins make potential projects more difficult to finance.

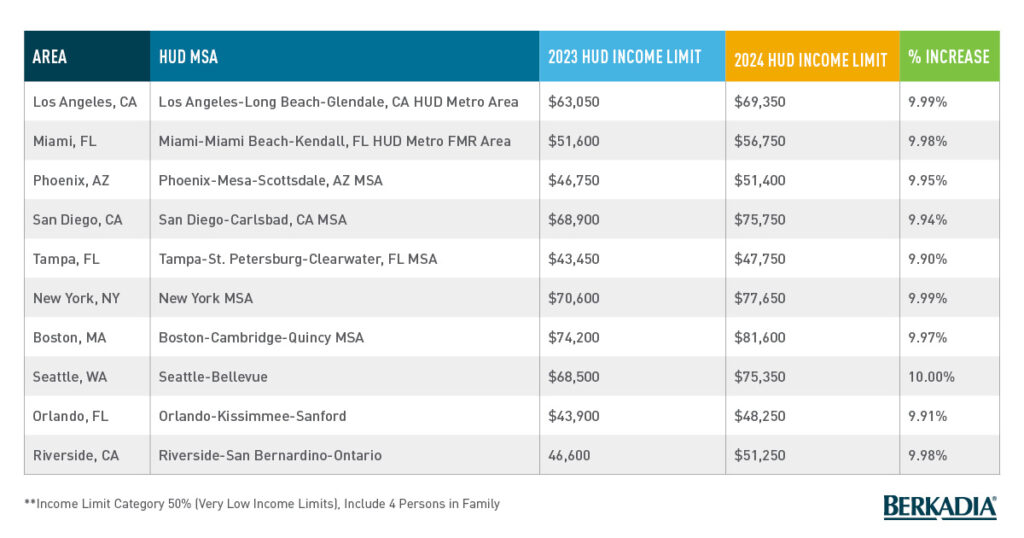

The cap will likely result in lower rental income for LIHTC projects that charge higher rents in markets where the increase would otherwise have exceeded the 10 percent cap. The chart listed below cites 10 markets that may have fallen into this category under the previous methodology.

Berkadia’s integrated affordable housing platform brings a balance of drive, versatility, and focus that comes only from deep experience in local, state, and federal regulatory and financing environments. As financial feasibility becomes more challenging, Berkadia’ team of affordable housing experts will work to maximize subsidies and investment opportunities.

Get in touch with an advisor today.