With a dearth of new supply and elevated interest rate levels, housing in the U.S. is becoming increasingly unaffordable for millions of renters across the U.S., particularly those earning between 30 percent-and 60 percent Area Median Income (AMI).

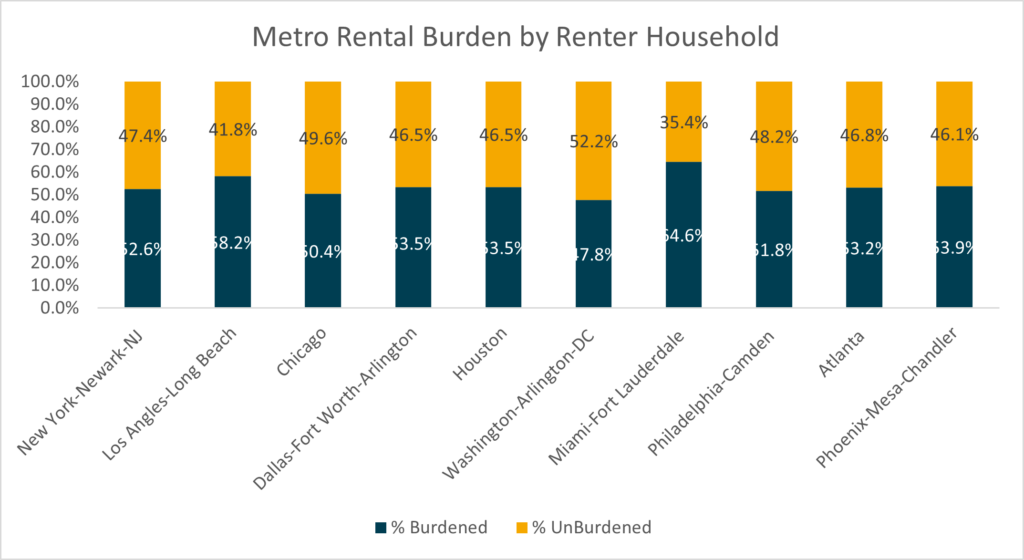

As of 2020 Census data, approximately 21 million renter households in the U.S. are cost burdened, which is defined as households that spend 30 percent or more of income on rent. This trend is expected to continue over the next several years. Through 2028, the median income in the country is forecast to increase 14.7 percent, according to Tetrad Computer Applications.

Source: US Census

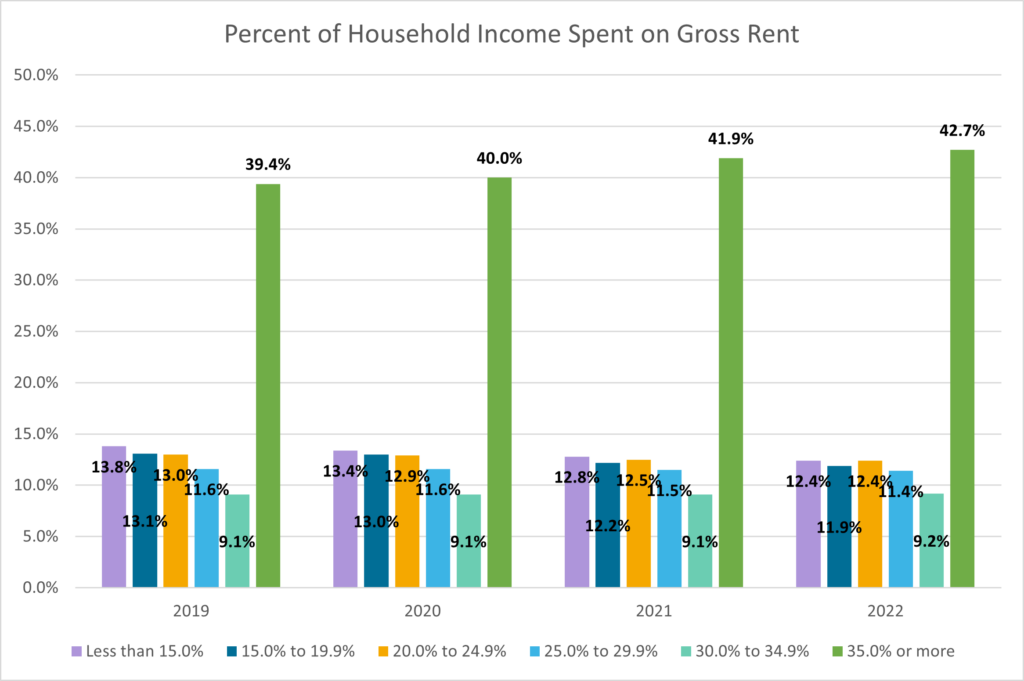

However, apartment rents are projected to outpace income growth over the same period with a 17.1 percent rise. This is compounded by the fact the U.S. apartment market experienced record rent growth during the past few years. As the chart below shows, the percentage of renters spending 35 percent or more of income on rent has risen over the past few years, a trend that is expected to continue.

Source: Moody’s Analytics, Census

With limited supply and rising rental prices, affordability will continue to be an issue for households across the country.

Hundreds of thousands of affordable rental communities could convert to market-rate housing in the next five years, as tax credits provided by the Low-Income Housing Tax Credit expire. According to a report from Moody’s Analytics, nearly 200,000 units could face significant rental increases by 2028 if owners decide to remove the income restrictions placed on the property. Additional data from the NHPD’s Picture of Preservation shows that affordability restrictions are set to expire for more than 700,000 federally assisted homes by 2030. Federally assisted housing stock must comply with affordability restrictions over a set period.

The LIHTC program initially included a 15-year compliance period in which it provides tax credits to encourage developers to build affordable housing and lower the cost of construction. However, beginning in 1990, Congress created an “extended use period” of an additional 15 years.

As a result, many properties are now nearing their expiration dates for the affordable program. If those limits are not renewed, then the restrictions expire and the tenants can be charged at market rates, therefore hurting the property’s affordability.

A significant amount of affordable housing has already been removed from the market. The National Low Income Housing Coalition reported that more than 500,000 units, or 8 percent of affordable stock, were lost between 2019 and 2021, as the real estate market experienced records levels of rent growth and incomes suffered amidst the COVID-19 pandemic.

Unless policy changes, more buildings will lose affordability status. According to the National Housing Preservation Database, affordability restrictions are set to expire for more than 327,500 federally assisted homes by 2026.

With interest rates likely remaining higher for longer as inflation persists, housing affordability will continue to worsen. Inflationary market conditions paired with low supply, scarce inventory and cumbersome zoning rules will also exacerbate the issue. In order to preserve affordable housing, federal, state, and local governments need to take action.

Connect with one of our trusted affordable housing advisors today.